Our Blog Post today is brought to you by fellow fee-only financial advisor, Gregory A. Johnston of Johnston Investment Counsel. His article discusses how to go about Developing a Strategy for Handling Student Loan Debt. Gregory A. Johnston, CFA®, CFP®, CPWA®, QPFC, AIF® has over 25 years of investment and comprehensive finanical planning experience. He started Johnston Investment… Read More

Two Key Benefits of Portfolio Diversification

Now that eight years have passed since the S&P 500 bottomed in March of 2009, I thought it would be a good time to revisit portfolio diversification. It’s easy to become complacent toward risk when the stock market keeps generally moving up from year to year. When times are good it is common that the… Read More

Unconventional Advice for College Students and their Parents

As a continuation of the Fee-Only Financial Advisor blog sharing group, this month’s post comes to us from Michael Garry, a Financial Advisor in Newtown, PA. He has some unconventional advice for college students and their parents. Millions of high school students are getting notified of their college acceptances and will soon decide what to… Read More

Ways We Can Use Money To Create Greater Happiness

As a continuation of the Fee-Only Financial Advisor blog sharing group, this month’s post comes to us from Lauren Zangardi Haynes, a Financial Advisor in Richmond, Virginia. She shares her thoughts on ways to utilize money to create greater happiness in your life. Money can’t buy happiness – or can it? While the phrase “money can’t… Read More

What’s The Best Way To Buy Gold?

As a continuation of the Fee-Only Financial Advisor blog sharing group, this month’s post comes to us from Joseph J. Alotta, a Financial Advisor in Oak Brook, Illinois. He shares his thoughts on how to purchase gold and silver coins for those investors preferring a small allocation of physical gold and silver. Admit it, you… Read More

What Is Retirement Planning?

One of the most rewarding aspects of my job is helping my clients plan for and transition to a successful retirement. I work with clients from a wide range of personal and professional backgrounds, such as: corporate executives, real estate agents, widows and widowers, teachers, engineers, CEOs, professors, policemen, divorcees, TV directors, business owners, therapists,… Read More

Don’t just quit – Retire to something

As a continuation of the Fee-Only Financial Advisor blog sharing group, this month’s post comes to us from Lauren Zangardi Haynes, a Financial Advisor in Richmond, Virginia. She shares her thoughts on how a fee only financial planner can help you with planning for retirement. Making the leap from a full-time career to retirement can be… Read More

A Basic Overview of CCRCs

One of the decisions we all need to make in retirement is how do we want to be cared for in our later ages when we may need some assistance. I think for most people, they immediately think of long-term care insurance, which may help to offset the cost of skilled nursing care needs, but… Read More

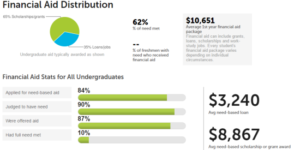

The Myth of the College Savings Penalty

As a continuation of the Fee-Only Financial Advisor blog sharing group, this month’s post comes to us from Ann Garcia, a Financial Advisor in Portland, OR. She shares her thoughts on saving for college and some of the myths surrounding the idea that one can be penalized for college savings by receiving less financial aid…. Read More