Many of my clients have children, grandchildren or other loved ones who plan to attend college in the future. However, it is becoming more challenging each year to plan for the cost of college as the costs are increasing at more than double the rate of inflation. This has been a consistent increase over the… Read More

Developing a Strategy for Handling Student Loan Debt

Our Blog Post today is brought to you by fellow fee-only financial advisor, Gregory A. Johnston of Johnston Investment Counsel. His article discusses how to go about Developing a Strategy for Handling Student Loan Debt. Gregory A. Johnston, CFA®, CFP®, CPWA®, QPFC, AIF® has over 25 years of investment and comprehensive finanical planning experience. He started Johnston Investment… Read More

Unconventional Advice for College Students and their Parents

As a continuation of the Fee-Only Financial Advisor blog sharing group, this month’s post comes to us from Michael Garry, a Financial Advisor in Newtown, PA. He has some unconventional advice for college students and their parents. Millions of high school students are getting notified of their college acceptances and will soon decide what to… Read More

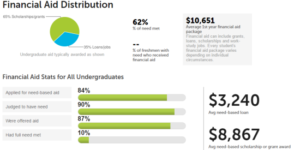

The Myth of the College Savings Penalty

As a continuation of the Fee-Only Financial Advisor blog sharing group, this month’s post comes to us from Ann Garcia, a Financial Advisor in Portland, OR. She shares her thoughts on saving for college and some of the myths surrounding the idea that one can be penalized for college savings by receiving less financial aid…. Read More