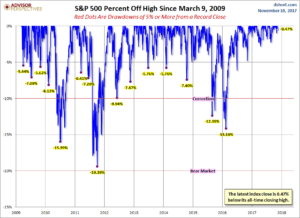

The stock market has been on a very strong run since the middle of 2016 with minimal volatility. As most long-term investors have experienced over the years, the market rarely keeps moving up for so long without some type of downward consolidation. I think this naturally begs the question – “when is the next stock… Read More

Ten Considerations If You Receive An Inheritance

At some point in your life you may receive an inheritance from a loved one or friend. There are a number of issues you should consider first before making any spending decisions: 1 – Don’t rush into any quick decisions You likely just lost someone close to you and, depending on the relationship, it could… Read More

5 Common 401k Problems Investors Make

This article was written by a special guest author and colleague, Stephen Reh. Stephen Reh CFA, MBA, CFP® is the founder of Reh Weath Advisors LLC and https://investwithsteve.com/, a fee only financial advisor in Southern California. Stephen is a member of the National Association of Personal Financial Advisors like David J. Fernandez, CFP® and specializes in financial planning and investment advice…. Read More

How Much Will I Pay For Medicare Premiums?

Note – some investors well below age 65 may not read this assuming it does not apply to them or Medicare is too far away. However, I think this is valuable information to understand because the federal government’s shift towards “means testing” will likely grow as a larger portion of the national budget transitions toward… Read More

401(k) Options When You Leave Your Employer

Regardless if you are retiring or moving to a new employer, once you leave your current job you will need to decide what to do with your 401(k). You have a handful of choices. I have outlined the benefits and disadvantages of each option below. Your personal circumstances may favor one option over the other…. Read More

Using Your IRA as Part of Your Wealth Transfer Legacy

I’d like to thank Michael J. Garry, CFP®, JD/MBA for today’s post about Using Your IRA as Part of Your Wealth Transfer Legacy. Michael is a Certified Financial Planner practitioner (CFP®) and financial advisor in Newtown, PA. His firm, Yardley Wealth Management, LLC, performs comprehensive financial planning and in-house investment management. I highly recommend if you’re… Read More

IRA Required Minimum Distributions (RMDs)

The IRS incentivizes investors to make tax deductible contributions to a number of different tax-deferred accounts such as an IRA, 401(k), SEP IRA, SIMPLE IRA or 403(b). For many investors this is their primary way of saving for retirement. The IRS allows the tax deduction on initial contribution and the continuous tax-free compounding of growth… Read More

Overview of Medicare Enrollment

One important area of planning for a successful retirement is to have adequate health care coverage. Health care costs have been escalating at over twice the rate of inflation for a number of years. For those wanting to retire prior to age 65, health care is typically one of the largest “bridge” expenses to cover… Read More

Ways We Can Use Money To Create Greater Happiness

As a continuation of the Fee-Only Financial Advisor blog sharing group, this month’s post comes to us from Lauren Zangardi Haynes, a Financial Advisor in Richmond, Virginia. She shares her thoughts on ways to utilize money to create greater happiness in your life. Money can’t buy happiness – or can it? While the phrase “money can’t… Read More

What Is Retirement Planning?

One of the most rewarding aspects of my job is helping my clients plan for and transition to a successful retirement. I work with clients from a wide range of personal and professional backgrounds, such as: corporate executives, real estate agents, widows and widowers, teachers, engineers, CEOs, professors, policemen, divorcees, TV directors, business owners, therapists,… Read More