I hope this finds you well in the New Year. Below are my thoughts on the current market climate. Let me start by saying the economy looks strong, consumers continue to spend, inflation is slowly coming down, consumer confidence is trending up, unemployment remains low and many continue to travel and play catch up on… Read More

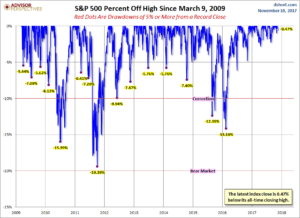

When Is The Next Stock Market Correction?

The stock market has been on a very strong run since the middle of 2016 with minimal volatility. As most long-term investors have experienced over the years, the market rarely keeps moving up for so long without some type of downward consolidation. I think this naturally begs the question – “when is the next stock… Read More

Ten Considerations If You Receive An Inheritance

At some point in your life you may receive an inheritance from a loved one or friend. There are a number of issues you should consider first before making any spending decisions: 1 – Don’t rush into any quick decisions You likely just lost someone close to you and, depending on the relationship, it could… Read More

Why Your Investments May Not Be Working For You

This article was written by a special guest author and colleague, Greg Geiger. Greg is a Principal of Financial Fiduciaries which is a fee-only investment advisory firm, registered with the National Association of Personal Financial Advisors (NAPFA), offering planning and investment services to individuals and institutions throughout Wisconsin. Our knowledgeable, experienced professionals serve as your advocate, helping… Read More

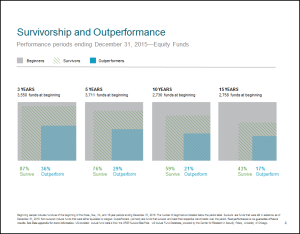

Survivorship Bias

Sports fans love to compare the sports heroes of their childhood era to current athletes and make a claim on who was the best ever. In many sports this claim on who was the best athlete of a particular time period can be subjective at best. However, baseball is one sport that allows for such… Read More

5 Common 401k Problems Investors Make

This article was written by a special guest author and colleague, Stephen Reh. Stephen Reh CFA, MBA, CFP® is the founder of Reh Weath Advisors LLC and https://investwithsteve.com/, a fee only financial advisor in Southern California. Stephen is a member of the National Association of Personal Financial Advisors like David J. Fernandez, CFP® and specializes in financial planning and investment advice…. Read More

401(k) Options When You Leave Your Employer

Regardless if you are retiring or moving to a new employer, once you leave your current job you will need to decide what to do with your 401(k). You have a handful of choices. I have outlined the benefits and disadvantages of each option below. Your personal circumstances may favor one option over the other…. Read More

Emotional Bias in Investing

This article was written by a special guest author and colleague, Stephen Reh. Stephen Reh CFA, MBA, CFP® is the founder of Reh Weath Advisors LLC and https://investwithsteve.com/, a financial advisor in Southern California. Stephen is a member of the National Association of Personal Financial Advisors like David J. Fernandez, CFP® and specializes in financial planning and investment advice. Do you… Read More

Markets Are Efficient

I would like to thank Greg Phelps for today’s article about Efficient Markets. Greg Phelps, CFP®, CLU®, AIF®, AAMS® is a 20+ year industry veteran. His firm Redrock Wealth Management provides fee only fiduciary financial advice and retirement planning to clients in the Las Vegas area. In 1965 Eugene Francis “Gene” Fama, (CEO of Dimensional Fund Advisors and Nobel laureate… Read More

The Biggest Challenge To Investing Success

Our Blog Post today is brought to you by fellow fee-only financial advisor, Phillip Christenson of Phillip James Financial. His article is about The Biggest Challenge to Investing Success. Phillip is a CFA, Chartered Financial Analyst, independent financial advisor and portfolio manager. He helps people with comprehensive financial planning, tax planning, and retirement projections. If you’re ever in… Read More